Knowledge to Benefit

Your Business & Employees

High quality labor consulting services for all types of employers, and video training for users of the H2A and H2B guestworker programs.

specializing in:

Uniquely Qualified

Labor Brain offers valuable insight from an uncommon perspective.

The secret to our success is fully understanding the three players in the labor compliance triangle (the government, employers, and employees). Our founder is a former investigator for the US Department of Labor who conducted audits, assessed fines, and enforced labor laws. She has a decade of employer-side consulting experience, as well as a great appreciation for employees and their concerns.

Seeing the situation from all sides and knowing how each party will respond gives us a powerful ability to resolve issues before they become costly, time-consuming problems. We speak everyone’s language and take pride in communicating respectfully while standing up for what’s right.

With Labor Brain, there’s no more convoluted jargon, just someone who understands where you’re coming from and can help you stay compliant.

Our Services

Making compliance easy.

We help employers every day by easing their labor compliance stress. Take a look at the six services we offer and see what will help you today.

Our Services

Making compliance easy.

We help employers every day by easing their labor compliance stress. Take a look at the six services we offer and see what will help you today.

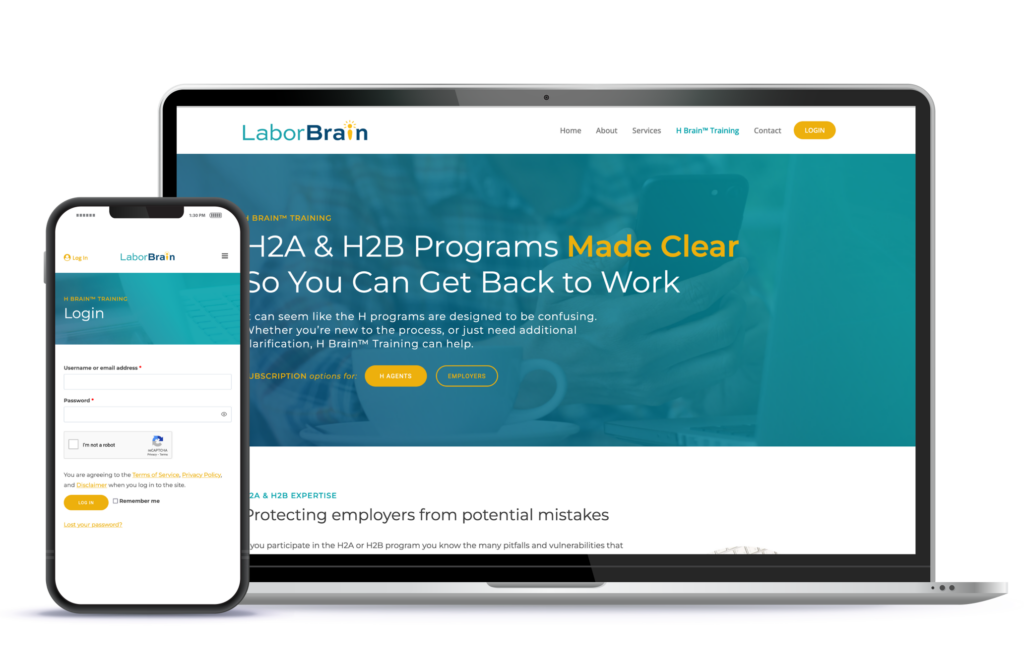

H Brain™ Training

The H2A & H2B video training you’ve been searching for!

Using the H2A and H2B programs can be difficult, leaving you constantly worried that you’re doing something wrong. After years of producing videos for employers and H agents we want to share this invaluable training with everyone who needs it. Take a moment to understand why we created this series for you.